Tell me if you can relate to this…

Tell me if you can relate to this…

You’ve painstakingly completed your most recent benefits enrollment guide/communication materials, which you vetted through colleagues, your team, corporate communications and your leadership. It has taken substantial time and energy ensuring accuracy, readability and finding the right balance between too much/too little information. The finished product is a document that can stand alone, and any employee can read it, understand their options, make informed decisions and enroll.

With this arsenal of great material available for employees to use to enroll in their benefits, you distribute the documents and then receive the following employee inquiries:

- What medical plan option do most other employees enroll in?

- I don’t have time to read through this information; can you just tell me what I should select?

- Does the company offer life insurance?

- How much does plan X cost me?

- Since the Y medical plan option costs me more, it must be the best one, right?

These are questions from those employees that I consider to be in a broad category of “disinterested or overwhelmed benefits consumers.” It’s important to note that many of these consumers are not:

- Incapable of understanding their benefits (I‘ve received some of these questions from PhDs);

- Lazy (also received from incredibly hard workers); and/or

- Indifferent about receiving employee benefits (some desperately need these plans).

Many of them appreciate and value their benefits – they just feel overwhelmed by the material or the options, or they don’t want to spend the time learning our benefits lingo and nuances. In many instances, these questions come from new employees, who have not had the time or opportunity to learn about their benefit options.

So, what’s a Total Rewards professional to do? Do you just send out the usual enrollment material and hope for the best, or devote significant time and resources to meeting with employees?

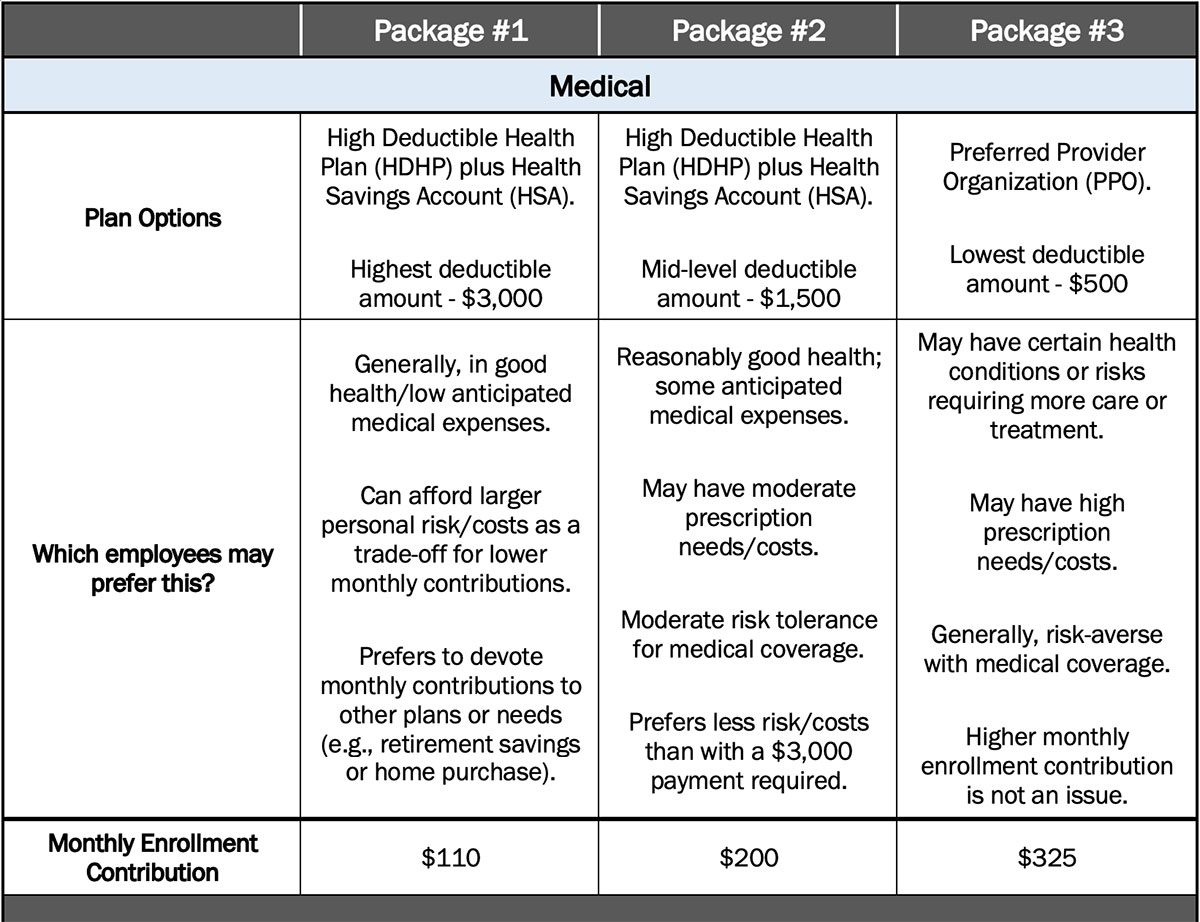

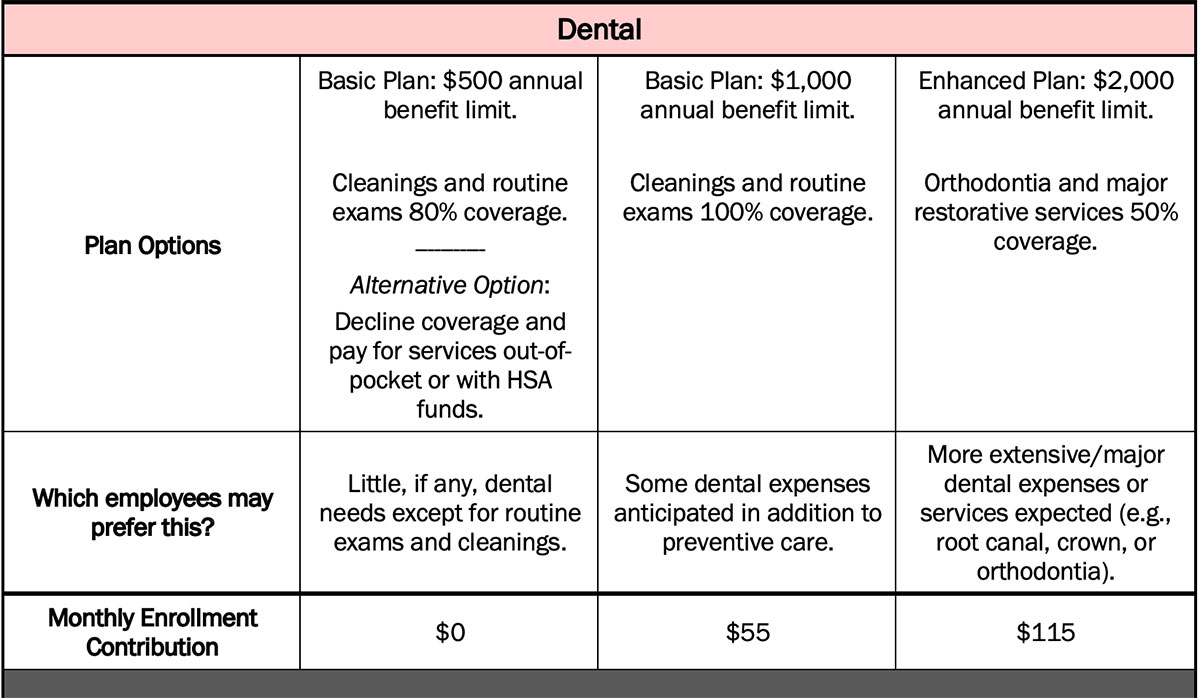

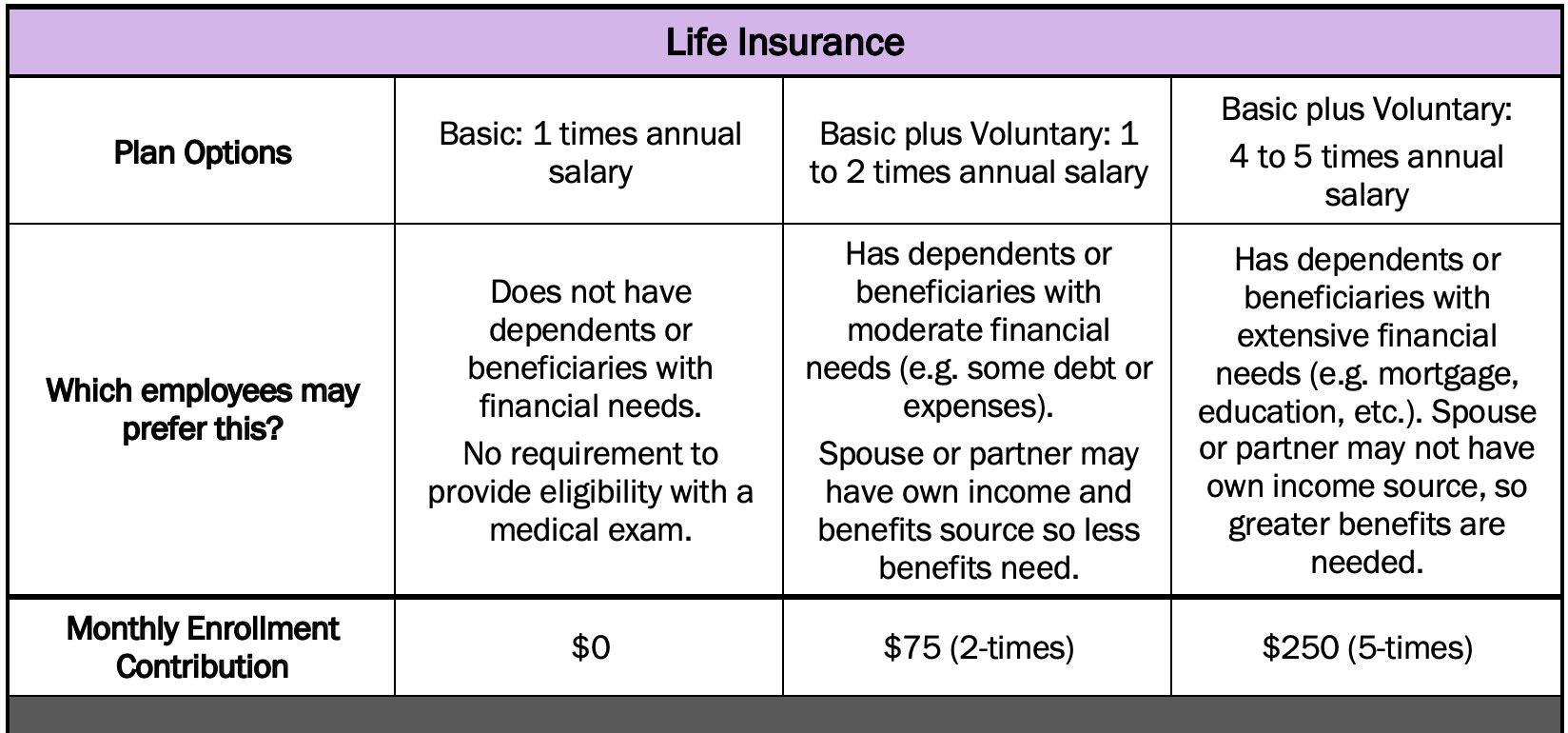

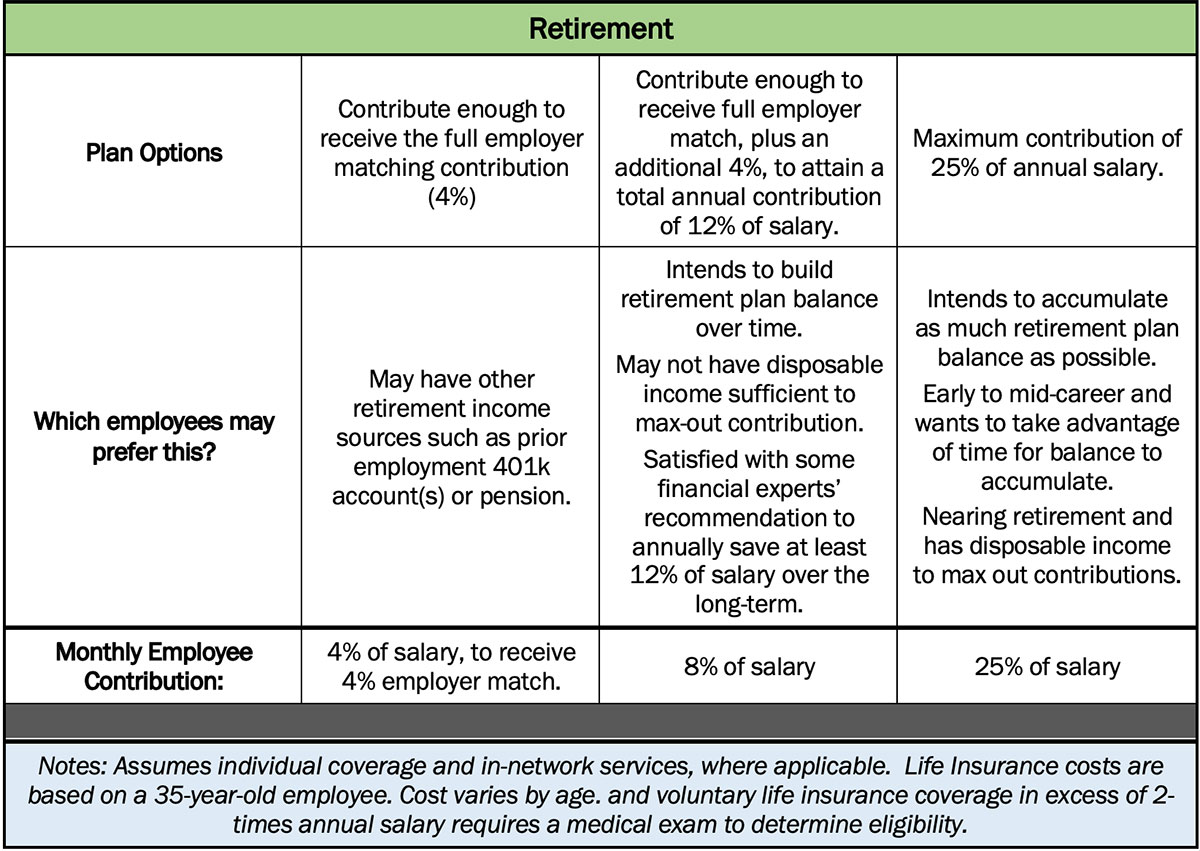

Consider “grouping” or “packaging” your employee benefits into sets that may appeal to employees who want or need less complexity. This communications approach assumes that you have sufficient plans and options to segregate into different groups, and it is not intended to be a flex or “cafeteria” plan design that was more popular in years past. There are no cost trade-offs by electing one benefit versus another. Rather, it is a means to present a significantly shortened version of plan options, with only the most important and differentiating points.

This information is not intended to replace your more extensive enrollment materials. It should be used to supplement – not replace – your current communications and may best be positioned as a lead-in or attachment.

Here is a hypothetical approach to grouping benefit plan options:

By Doug Stewart, MBA – Senior Total Rewards and HR Consultant

[Note: You will want to Insert appropriate caveats and disclaimers here, including a strong recommendation to review the full plan description in the enrollment guide and/or the Summary Plan Description.]

Remember: Employees do not need to elect benefits in accordance with the package choices in each column; they can “mix and match” as they prefer (e.g., Package #1 Medical and Dental; Package #2 Life and Package #3 Retirement). These are simply options and “groupings” of benefits to consider in a simplified manner.